11 February 2022

PRODA looks like a horror show for certain healthcare providers

It’s a perfectly natural technology iteration for our healthcare services infrastructure, but beneath the PRODA deadline lies some seriously difficult issues for healthcare providers and digital health vendors which the government is either underestimating or thinking they will simply “push through”.

News earlier this month that our largest patient management vendor needs another three months or so to prepare properly for the new Medicare Web Services regime is late warning that the scale and ramifications of this impending change for healthcare providers is much bigger and worrying than many have so far realised.

It is understood that quite apart from the issues faced by the major primary care software vendors in meeting the deadline, nearly all hospital software vendors in the country won’t be able to meet the PRODA deadline either.

PRODA (provider digital access) is an online authentication system that Services Australia are starting to use to verify the identity of users who want to access important government online services.

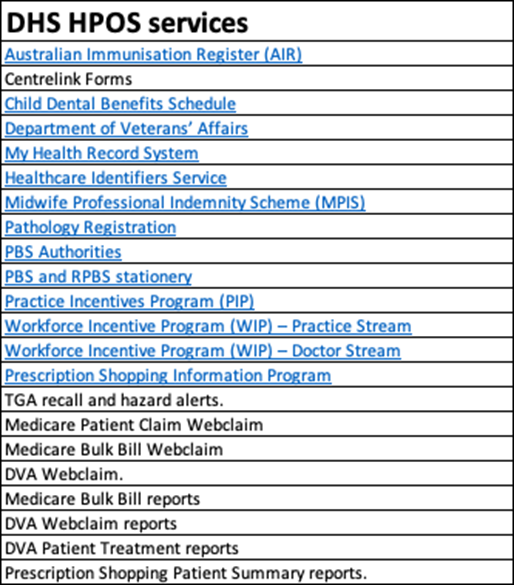

In the case of healthcare providers, it will be needed to access the Department of Human Services (DHS) HPOS (Health Professional Online Services) which processes just about every important healthcare transaction you can think of (see Table below).

From a vendor perspective, if you aren’t cloud architected, PRODA is a bit of a nightmare.

For vendors like Best Practice and Medical Director, whose major products in market are desktop based server bound applications, each instance of their software is likely to require an individual PRODA registration. That’s a hassle for both the vendor, who has to do a fair bit of coding to get things to work, and the actual medical practice, which has to go and get themselves a PRODA account and maintain it.

Cloud vendors, like Claiming.com.au and MediRecords, won’t have to annoy their clients by getting them to register for PRODA to make their claiming work, as using their architecture, they are able to use one PRODA account obtained by them, for all their clients, who will be linked to that account through their individual unique provider IDs.

From a provider perspective, PRODA is only just starting to cause some panic.

Most medical practices will need a PRODA account whether they are using a cloud PMS vendor or not. There are just so many services on HPOS beyond claiming, such as PIP, that they are going to need to access.

But getting an account is not the worry for most medical practices.

What is most worrying is that the requirement to register for PRODA is throwing into the spotlight the tax structures of a very large number of medical practices and whether they are compliant, particularly in terms of state government directed payroll tax.

Technically, the way Medicare billing works is that the doctor who is performing a consult charges the patient, and takes the money from that patient.

Theoretically, they should be invoicing the patient, but that does not happen much, if at all, in general practice, as it has been impractical to set up and maintain. Mostly the record of service is not an invoice but the monetary transaction between a practice and a patient, not the actual consulting doctor and their patient.

There’s a big potential problem with this because this flow of money tends to indicate to state revenue bodies that the doctor is actually an employee, not a contractor.

The vast majority of GP practices are not set up to have their individual contractors perform the transaction and make the Medicare claim, and then charge them after the fact for their ‘rental’ of space and infrastructure.

Most often, the money from a consult is transacted by the practice, often with a practice ABN (some are smart enough to send use the contractor doctor ABN), and flows to a practice first. It then is then remitted to the consulting doctor.

PRODA is not requiring any change any to the functionality of how transactions are reported and made or any new information to be submitted, so in one respect, you’d think there would be nothing changing about how tax structures are viewed.

But if you are going to make a Medicare claim in the future, you need to have a PRODA account.

If all those contractors out there whose transactions are handled by their practices now, don’t get PRODA accounts, how are those contractors to be seen in terms of being the ones that actually made the Medicare claim and earned the revenue in the first place?

There is sordid devil in the detail of what is occurring here that is probably not immediately obvious to individual doctors, many practices and perhaps even the DHS.

PRODA says that an organisation or entity can register and requires the ABN number of that entity.

But you aren’t entitled to make a Medicare claim using a different ABN to the entity that performed the service. I.e., a Medicare claim can only be made by the doctor performing a consult, using their ABN number. If so facto, every doctor now needs a PRODA account?

By March 13?

On spec, it doesn’t look like this is the intention of DHS.

Looking at all the forms and documentation it looks like the intention of the DHS is that an organisation can use the unique ID of their contractors to make the claim on their behalf. That’s the best reading we can make of the documentation anyway.

The problem with this is that in the last year various state governments have upped the ante significantly on assessing medical practices for payroll tax liability. In some significant cases so far, state government revenue offices have demanded back taxes. In a recent case that demand has been for nearly $1 million.

The structure which the DHS seems to be requiring is in conflict with the interpretation that various state government revenue offices are giving to the set up of a lot of medical practices, which is not one generally of employee-employer in terms of relationship.

The tax system is conflicting with the claiming system. It always has, but the advent of the new PRODA regime is putting the problem up in lights.

The deadline to register for PRODA is March 13, after which it was initially claimed by the DHS that a provider or practice would be disconnected from claiming.

Wild Health has been told by several sources that March 13 is more “a stake in the ground” from the DHS, than an “actual deadline”.

“Nearly everyone is going to request a new deadline, and get granted one”, one vendor assured me this week.

If the largest PMS in the country has applied for and gotten a three month reprieve, you can imagine that now every vendor will be able to apply for an extension (we know a few who are planning this way) and with that the providers will have more time to think about their problems as well.

But the tax problem for the providers, mostly GP medical practices, is not one that is likely to go away.

State revenue offices will all be able to point to the new Medicare Web Services regime, the requirement to register for PRODA with an ABN, and ask, if your doctors are really contractors, why aren’t they registered on PRODA and making their own claims on their own ABNs?

It feels like it’s going to come up in a case brought by a state revenue body sometime in late 2022 or early 2023, when the new DHS system is actually starting to take hold and various practices are submitting claims on behalf of their contractors.

That the DHS will allow the use of the older alternate KPI authentication system as far out as 2024 gives you some sense that the federal government understands that the changes it has forced upon both the software vendors, and through them, their medical practice clients, are seismic, and will need time to get right.

No one is going to be cut off from claiming any time soon, despite the March 13 deadline it appears. Which is a good thing.

But how long before state governments start asking tricky questions about contractors, PRODA, which ABNs are being used, and so on?

Just how impactful the intersection of the current jihad by state revenue bodies on medical practices in search of new payroll tax revenue with the federal government’s determination to move their claiming interface to the web will be, is still unclear.

At the federal and state level, data matching services on an intra and inter departmental basis are increasing in momentum a lot.

Although there are no new functionality requirements in the new Medicare Web Services regime, the cloud based system has the capacity for handling a lot more data.

As an example, if all doctors who do a consult were to register for PRODA, and send their claims individually to the DHS, the system could easily handle it.

From a DHS perspective, the detail of this information isn’t that interesting.

But from an ATO perspective, and from a state revenue office perspective, the detail might be compelling.

With current and evolving data matching capability, various government departments, state and federal would be able to instantly understand which medical practice were invoicing correctly for tax and payroll tax purposes, and which practices might be more treating employees as contractors for payroll tax purposes when perhaps they shouldn’t be.

For providers, already in the midst of covid induced stress to their systems and businesses, these changes are currently looking like they might end up as a horror show.